The six principles of finance include all of the following except. Finance questions and answers.

The following data are available for the two plants.

/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

. Treasury bills are considered the safest of all money market instruments because there is almost no risk of. Securities and Exchange Commission SEC requires that a minimum of 95 percent of the securities in a money markets fund must have earned the highest possible rating from at least two major institutions that. Which of the following is true regarding money market securities.

The five Cs of credit include all of the following except. Negotiable certificates of deposit D. Fee Based services includes all of the following except.

All of the above are life stages of savers. Items that fall outside the definition of research reports include all of the following EXCEPT. Diversification of investments can reduce risk d.

Diversification of investments can reduce risk. Question 4 4 points Money market securities features include. Current account includes all of the following except.

The worlds major trading currencies which are a free to float against each otherinclude all of the following except_____ Fund based services includes all of the following except. The formativeeducation developing stage b. Financial markets are efficient in pricing securities e.

Veterans Administrations O US Treasury Sallie Mae Federal Land Banks. A T-notes and T-bonds can be considered money market instruments when they have only a year left to maturity. A It determines the level of interest rates.

Higher returns are expected for taking on more risk c. Certain types of money market investments specialize in one type of. C mature in one year or less.

One of the parts of a financial market in which short-term financial instruments are traded is termed as money market. The career earningfamily creating stage c. These securities include federal and municipal bonds certificates of deposit from financial institutions and commercial paper a kind of unsecured IOU from large corporations.

All times are ET. B have low default risk. SIE - Securities Industry Essentials Exam.

When the number of working days exceeds 240 overtime charges raise the variable manufacturing costs of additional units by 300 per unit in Peoria and800 per unit in Moline. Most stock quote data provided by BATS. Money has a time value.

This includes assets such as certificates of deposit CDs interbank loans money market funds Treasury bills T-bills repurchase agreements commercial paper and short-term securities loans. A money market fund is a kind of mutual fund that invests in highly liquid near-term instruments. Money market securities have all the following characteristics except they are not a short term.

D Money market securities generally have the following characteristics short low from FNCE 3P93 at Brock University. Money market securities are typically debt instruments with a hefty face value of 100000 or more. These instruments include cash cash equivalent securities and high-credit-rating debt-based.

The six principles of finance include all of the following except. Money has a time value. A market can be described as a money market if it is composed of highly liquid short-term assets.

All of the choices. Terms in this set 40 1. When all or a portion of an ETFs underlying securities trade in a market that is closed when the market for the Funds shares is open there may be changes from the last quote of the closed market and the quote from the Funds trading day which could lead to differences between the market value of the Funds shares and the Funds.

Money market instruments a are usually sold in large denominations. Higher returns are expected for taking on more risk. C T-bills notes and bonds are all considered money market securities at the time they are issued.

Every financial market has the following characteristic. Money market securities include. Most money market securities act as short-term bonds and are purchased in vast quantities by large financial entities.

For all intents and purposes you can view money market securities as cash in a portfolio. Prep for the financial exam with our sample questions. All fixed costs per unit are calculated based on a normal capacity usage consisting of 240 working days.

Government regulations to reduce the possibility of financial panic include all of the following except. Low default risk all of the others short maturities large denominations Question 5 4 points Agency bonds mean all of the following except. Money market securities are investments that provide investors with higher levels of yield interest than a checking or savings account while still offering the same level of principal protection as outright cash.

Money market securities generally have the following characteristics. Money market securities are considered to be very safe because they are issued by companies that must have very high credit ratings. D are characterized by all of the above.

All of the following are money market instruments except - Financial Questions with explanations from our expert instructors. These include Treasury bills bankers acceptances purchase agreements and. Market indices are shown in real time except for the DJIA which is delayed by two minutes.

All of the following are money market securities except - Financial Questions with explanations from our expert instructors. It is used as a means to borrow and lend in the short term. The life stages of an individual saver include all of the following EXCEPT.

Short _____ low _____ and high. The wealth building stage d. Treasury bills and commercial paper.

Funs based services includes all of the. Unit 1 Unit 2 Unit 3 Unit 4. B Only T-notes can ever be considered money market securities.

Among the above-mentioned options commercial paper and treasury bills are its securities.

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

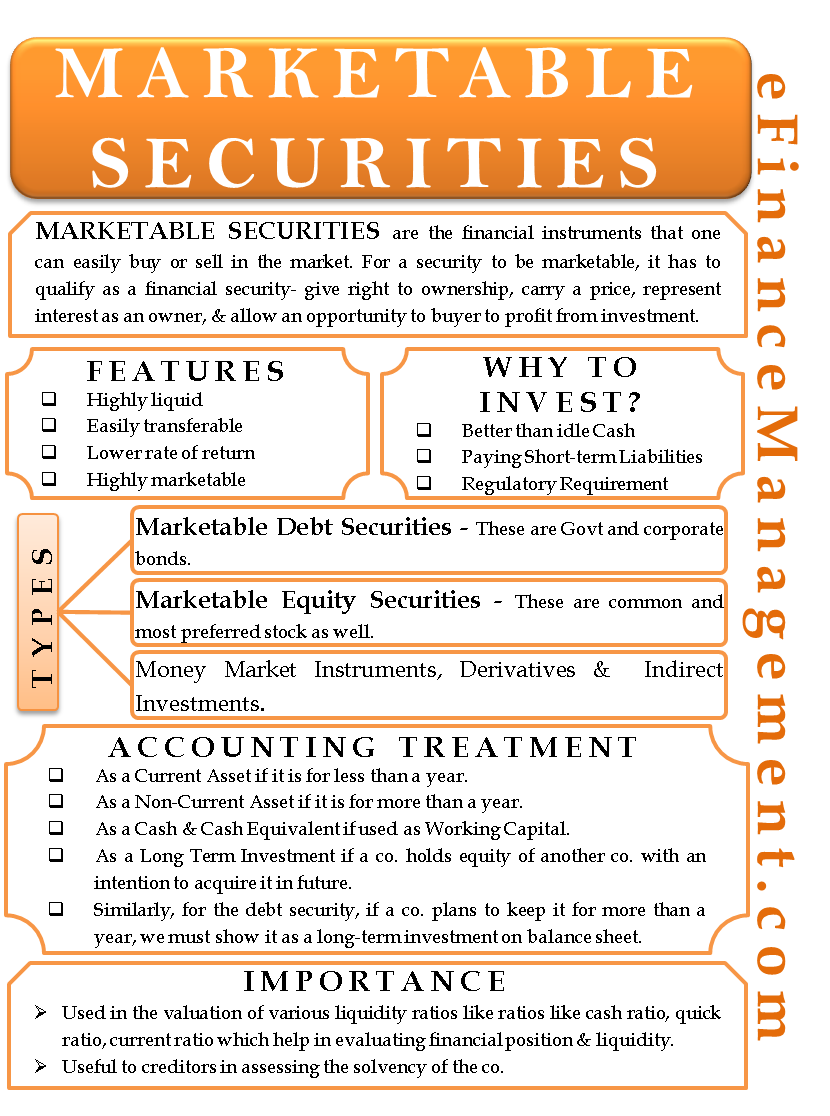

Common Examples Of Marketable Securities

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)

0 Comments